What is the Future of the $1m+ Art Market? A new partnership between Sotheby’s and ArtTactic has all the answers

Year after year, auction after auction, fair after fair, sale after sale, art world professionals continuously ask one broad question: “What is the future of the art market?”. And the answers are never the same. In one quick Google search, a curious mind is presented with an enormous slew of statistics and opinions that, if anything, make the already dynamic and ever-changing market seem that much more enigmatic.

Cover of “Peak Performance: The Art Market Beyond $1 Million, 2018-2022”.

On Monday, 27 February, Sotheby’s hosted the first in a series of panel discussions in collaboration with ArtTactic that will provide a definitive answer to this seemingly unanswerable query. Moderated by author Georgina Adam, the panel consisted of top industry executives - Sotheby’s own Brooke Lampley, David Schrader and Damian Leslie, alongside ArtTactic founder and Sotheby’s Institute of Art consultant Anders Petterson - all of whom brought their expertise and insights to the discussion.

Entitled “The Art Market Beyond $1 Million”, the event shed light on the findings from research carried out by ArtTactic that comprise the premier Sotheby’s Insight Report, released just yesterday. As its title suggests, the report examines the market for works sold above $1 million. Specifically, it uses data collected from private, bidding and public sales from the top three international auction houses - Sotheby’s, Christie’s and Phillips - between 2018 and 2022.

Why this specific timeframe? As noted by Petterson, this five-year period was a ‘perma-crisis’ - a period of extremes - due to the plethora of extremes in the world that include the COVID-19 pandemic, Brexit, the war in Ukraine, inflation, unemployment, and the storming of Capitol Hill to name but a few.

The event’s setting was in the lower pre-sale viewing rooms decorated with exciting lots due to be auctioned at the upcoming “Surrealism & Its Legacy” sale hosted at Sotheby’s Paris headquarters on Wednesday, 15 March. Francis Picabia’s radical mechanical painting Novia from c.1916-17 acted as the backdrop to the panellists’ stage. Sold for €2,226,000 (from an estimate of €2.5m-€3.5m), the picture certainly put the audience in the spirit of discovering more about the $1m+ niche in the market [1].

Francis Picabia, Novia, c. 1916-17. Gouache and oil on paper laid down on canvas, 115.9 x 88.7 cm. Courtesy Sotheby’s.

Within the entire scope of the report, Petterson shared five key discoveries with the audience: shifts in market size, resilience, changing taste, geographical shifts, and generational shifts.

Market Size

Although it is unsurprising that 74% of total auction sales value came from works sold for $1m+ (particularly given that the total combined sales from art and collectables of the big three in 2022 were $17.6bn), it is shocking that these works represent only 4% of lots sold between these five years [2 & 3].

It is even more surprising to discover that only 63 works sold for over $50 million [4]. This is primarily because of the unprecedented press coverage for last year’s successful single-owner sales in which most works sold for multi-million dollar prices (and accounted for almost one-third of total sales in 2022). Ignoring the media storms of late, it is well understood that most items sold through auction houses, both privately and publicaly, sit at a much lower price point, namely prints, drawings, photographs, and collectables. But, as the data shows, these alone cannot account for the staggering annual results year on year.

Price segmentation for $1m+ works 2018–2022.

From this, it is no surprise that of the $1m+ market, the $1m-$5m price segment is the largest, accounting for $10.17bn, followed closely by $5m-$20m at $9.74bn [5]. According to Schrader, the $1m-$5m range is the healthiest of the group, particularly concerning private sales. This is because, in art market terms, this is the least risky price range to get involved with. Consequently, this bellwether market trend suggests that whilst auction houses might sell a higher quantity of works below $1m, the works at the top end drive the market year on year.

Resilience

As mentioned earlier, suggesting that 2018-2022 was eventful would be an understatement. Many would describe it as turbulent, violent, bizarre, unprecedented, radical and drastic.

However, the art market was operating on a different plane entirely. Strangely, private sales of the $1m+ market peaked during the pandemic’s peak in 2020. Although online, live-streamed sales proved highly successful and incredibly innovative, auction houses nevertheless needed the strong performance of works sold in private sales to offset the fall in public auction sales that year.

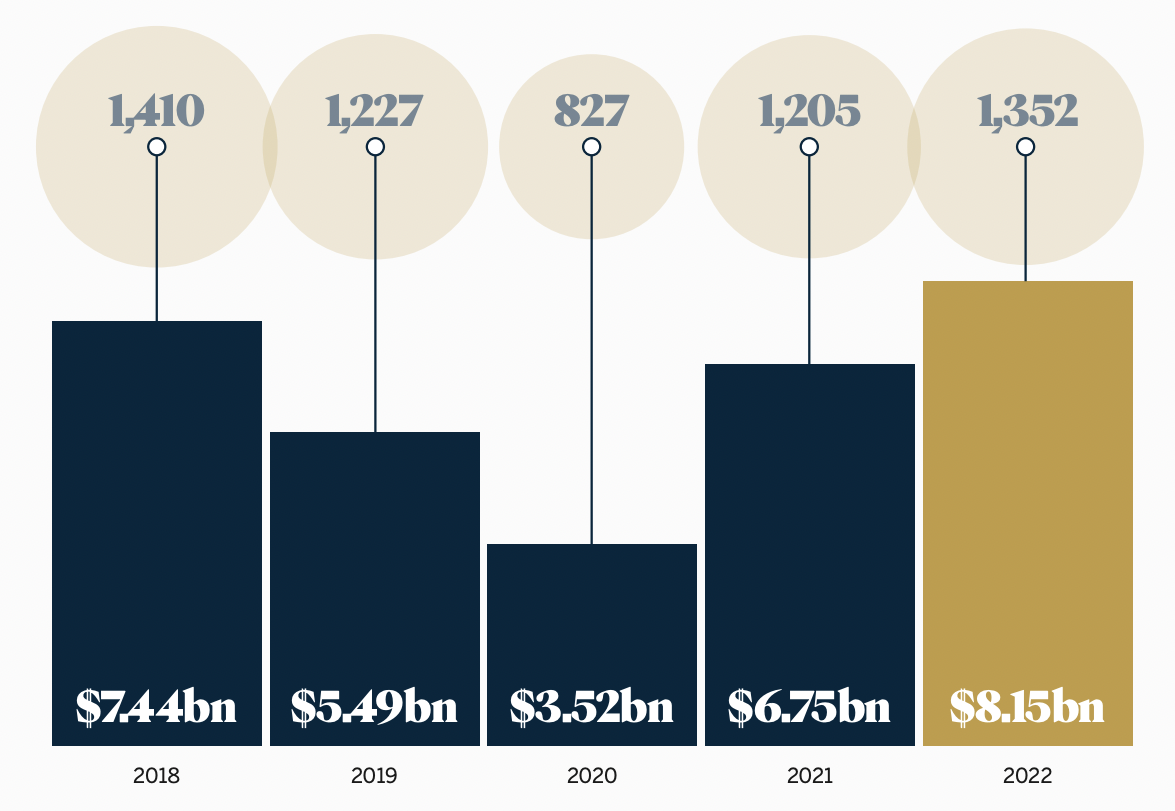

Overall sales by value 2018-2022.

But in 2021, whilst the political, social and economic world continued to struggle, the art market had a strong post-pandemic recovery in public auctions, generating $6.75bn in overall sales (private and public), up from $3.52bn the year before [6]. Seems peculiar, right?

But if one takes a step back, this may not be so strange. What does the more significant number of high-value private sales in 2020 tell market analysts? What does the growing financial success of sales in 2021 tell us? The arrow points towards art as an increasingly beneficial and viable asset class.

Art was booming during the pandemic when most other markets were either tanking or slowing down and remaining stagnant at best. This was largely due to the auction houses’ technological adaptability, allowing collectors and investors to buy art online, creating a whole new avenue to carry out business. Quickly, people learnt that art was an asset that one could trust rather than a tool to make quick cash. Additionally, Lampley noted how interested parties could clearly understand each lot's interest prior to the sale, thereby leading to a much larger guarantee pool. Guarantees are essential for the consignor and as a benchmark for potential buyers. They allow for additional security in each sale: happy sellers, auction houses, and happy buyers.

This sentiment is perfectly summarised by Sotheby’s Institute of Art MA Art Business Director, David Bellingham, who wrote in the report’s introduction, “it is the unique, hedonic nature of art that makes it so desirable – and more valuable – than other luxury assets such as jewellery and watches.” [7] Thus, it is no surprise that overall sales results grew exponentially once the world opened its doors, and the market has been steadily growing ever since.

Changing Tastes

In a December 1968 interview for ARTnews with Francis Roberts, Marcel Duchamp famously declared, "Taste is the enemy of art.” [8] According to this report, taste, however, is not the enemy of the art market. Instead, it is one of its major driving forces.

Works sold for $1m+ by section.

According to the data collected for the report, four categories have come to the fore over the last two years: Old Masters, Impressionist & Modern, and Contemporary art. High-profile single-owner sales such as the Paul G. Allen Collection (Christie’s, 2022), the two-part Macklowe Collection (Sotheby’s, 2021 & 2022), to name but a few, have been the catalyst for these changes in taste, particularly within the younger generation of collectors. The effects have been so significant that the sales total for each of the three categories (for works over $1m) was at its highest in 2022, generating $390.4m, $4.25bn and $3.34bn, respectively [9].

The growing diversity in popular genre sectors reflects the current collecting and investing tastes. Lampley noted how collectors are becoming less interested in acquiring one specific artist, style or theme. Rather, she said, they desire the best examples by the most exciting artists, regardless of aesthetic vision.

Additionally, Schrader noted that this increasing interest in older artworks reflects collectors’ desire for safety. These works have an established reputation, recognised prestige, and deep-rooted cultural value that contribute to their continued importance within one’s portfolio. Resultantly, more people are interested in purchasing works of art they are confident will be stable investments.

The rise of artworks by women artists in the high-end Contemporary market.

There has also been an incredible increase in the market for $1m+ works created by women artists. Compared to the meagre 72 women artists in this category in 2018, 2022 saw 174 women break the million-dollar barrier - an incredible 141.7% increase [10]. Whether this is due to the significant rise in publications centred on women artists, including Katy Hessel’s The Story of Art Without Men, or the growing number of museum and gallery exhibitions featuring, or entirely focussed on, women artists, the proof is in the auction pudding. Women artists are finally beginning to gain the market recognition they deserve. This is particularly relevant in relation to the growing popularity of ultra-contemporary women artists such as Jadé Fadojutimi, Anna Weyant, Christina Quarles and Flora Yukanovich. These auction house darlings have been sweeping the salesroom in recent years and achieving unprecedented results.

Surrealist artists' rise 2018-2022.

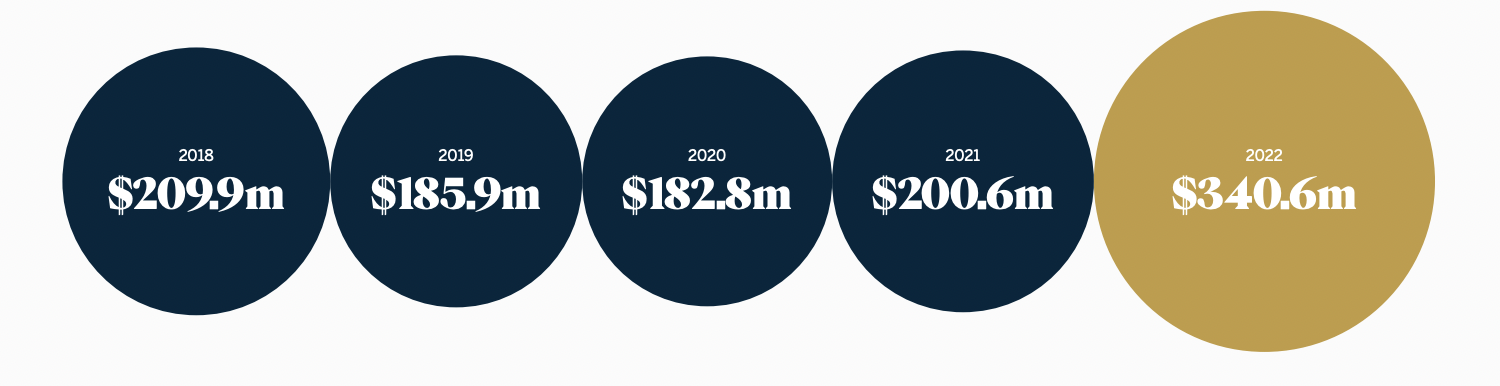

Hinging off the back of this era of renewed interests, Surrealism, too, has gained greater market recognition amongst buyers. In the same manner as women artists, the increasing number of books and museum shows in recent years about Surrealism has escalated its prices at auction and now comprises 7.4% of the Impressionist & Modern market [11].

Interestingly, this growth was particularly significant post-pandemic, with sales values in 2022 rising to a five-year high of $340.6m, up by 69.8% from 2021 and 86.3% from 2020 [12]. We may be over the real-life dystopian environments of the pandemic, but who’s to say it doesn’t live on in the desires for strange apocalyptic subjects produced by the likes of René Magritte, Marc Chagall, and Joan Miro…

Geographical Shifts

Over the last five years, Asia has become a significant player in the global art world. It is now the home to big new fairs, including Frieze Seoul and Art SG, and has produced some of the most successful art endeavours of late, such as Art Week Tokyo [13]. This has attracted leading international galleries such as Gagosian, Pace and Lévy Gorvy to the continent. Furthermore, auction houses are hopping on the trend, with many auctions offered at Christie’s headquarters in Hong Kong and Sotheby’s hosting its first live auction in Singapore in fifteen years.

Distribution of unique bidders by region.

But behind the closed auction house doors, the demand for art is even more prevalent. The report reveals how Asia accounts for one-third of the bidding pool for the $1m+ sector and, alongside institutional prestige and single-owner sales, has accounted for the surging interest in Impressionist & Modern and Contemporary works of art. Specifically, Asian buyers represent 32% of unique bidders, only 2% less than the leading region, North America [14].

Adopting a more realistic and rational perspective, David Schrader observed how Asian buyers often bid against one another, driving up the price of specific works of art. Additionally, he mentioned that, although Asian buyers have become very invested in the auction house world, this same buzz has not translated into the commercial sector, with the UK and USA continuing to dominate the gallery scene. Thus, although Asia is catching up, their overall art market spending is smaller and ultimately less mature than in the West.

Generational Shifts

Just as Asia is making their mark in the $1m+ sector at auction, the younger generations are too. So step aside Post-War and Baby Boomer buyers; GenX, Millennials and GenZ are in.

Aside from the obvious… the younger generations have been swarming the public salesrooms and positioning their paddles up high to get the winning bids. As Bellingham observed, this is undoubtedly due to the increasing rise in global wealth among the younger generations, which has significantly increased the high-end sales of fine art at auction [15]. This prompted panellist Leslie to note how, as a result, the younger generations are more financially flexible. Consequently, younger generation collectors are more likely to take risks and be more experimental with the works they purchase, which not only contributes to the changes in tastes but also contributes significantly to the size of the market. Thus the data suggests that the younger generations are happy to play the auction house game, whether it is with the intent of growing an art collection for personal enjoyment or acquiring art for investment purposes.

Further contributing to this is improved access to information and education on art and artists. Adding to Leslie’s argument, Lampley observed how this increased buyers’ confidence when bidding as interested parties could learn more about the market segment and the artists for sale ahead of the bidding wars. Consequently, there is a deeper understanding of the market than ever before, ultimately making the auction world more accessible to a broader age bracket. Undoubtedly, the competitive thrill permeating the live auctions in the salesroom has also contributed to the decreased age average in the auction room. So, let the bidding war commence!

Takeaways

This unprecedented art market transparency provided by ArtTactic and Sotheby’s report sheds light on new insights within the $1m+ market segment. The extreme taste, generational and geographic shifts demonstrated by the data collected allow for a better understanding of the thought mechanics behind collecting art and how one responds to it. Most importantly, the report revealed how, in times of extreme uncertainty, the art market is adaptable, reliable, firm, diverse and exciting.

Bellingham’s confident concluding remarks, however, provide a glimpse of what can already be determined: “As long as younger generations regard art as an important signifier of lifestyle, community action and philanthropy (as well as a canny investment), and older wealthy individuals as a marker of status and acquired knowledge, the $1m+ art market is surely set to grow.” [16] Whether this growth will happen, who is to say? Let us revisit this subject after what will unquestionably be another fascinating five years.

Special thanks to Sotheby’s and ArtTactic for allowing MADE IN BED to attend this conference. To listen to the full panel discussion and talk, click here.

To read the full “Peak Performance: The Art Market Beyond $1 Million, 2018-2022” report, download it here.

All graphics courtesy of Josh Gowen.

Footnotes:

“Francis Picabia, Novia. Lot 1,” Surrealism & Its Legacy, Sotheby’s, accessed March 15, 2023, https://www.sothebys.com/en/buy/auction/2023/surrealism-its-legacy/novia-2.

Rupert Neate, “Auction houses celebrate bumper year of blockbuster art sales,” The Guardian, accessed March 9, 2023, https://www.theguardian.com/business/2022/dec/28/auction-houses-celebrate-bumper-year-of-blockbuster-art-sales#:~:text=In%20total%2C%20the%20three%20big,and%20other%20collectibles%20in%202022.

ArtTactic and Sotheby’s, Peak Performance: The Art Market Beyond $1 Million, 2018-2022, (London: 2023), 4.

ArtTactic and Sotheby’s, Peak Performance, 15.

ArtTactic and Sotheby’s, Peak Performance, 16.

ArtTactic and Sotheby’s, Peak Performance, 13.

David Bellingham, “The Changing Nature of the $1m+ Market,” in Peak Performance: The Art Market Beyond $1 Million, 2018-2022, ArtTactic and Sotheby’s (London: 2023), 9.

“From the Archives: An Interview with Marcel Duchamp, From 1968,” ARTnews, accessed March 10, 2023, https://www.artnews.com/art-news/retrospective/archives-interview-marcel-duchamp-1968-11708/.

Balasz Takac, “This Year Generated a Record Number of Single Owner Collections Coming to the Auction,” Widewalls, accessed March 12, 2023, https://www.widewalls.ch/magazine/single-owner-collections.

ArtTactic and Sotheby’s, Peak Performance, 31.

ArtTactic and Sotheby’s, Peak Performance, 41.

ArtTactic and Sotheby’s, Peak Performance, 41.

“Asia’s Art Market Is Back in Business,” Sotheby’s, accessed March 11, 2023, https://www.sothebys.com/en/articles/asias-art-market-is-back-in-business.

ArtTactic and Sotheby’s, Peak Performance, 20.

David Bellingham, “The Changing Nature of the $1m+ Market,” 8.

David Bellingham, “The Changing Nature of the $1m+ Market,” 10.

Ilaria Bevan

Editor in Chief, MADE IN BED