Own Less, Control More: The Resale of Luxury

In April 2025, a wave of viral short videos on TikTok and Instagram sparked fresh controversy in the luxury industry, adding pressure to a sector that is already facing reputational challenges and declining sales. In the video, Chinese factory workers walk past shelves of polybagged handbags, claiming to once supply Hermès, Chanel and Louis Vuitton, and now offering convincing dupes at a fraction of the original prices. [1] These contents were created in response to the rising US tariffs and challenged luxury’s most sacred myths: artisanal heritage, European craftsmanship, and above all, the legitimacy of luxury pricing. Most of the claims were unverifiable or misleading, while Hermès, Chanel, LVMH and Kering all either did not respond or declined to comment on the news.

Luxury brands have long been relying on carefully crafted narratives and storytelling, holding exceptional economic and cultural capital. However, new media and platforms (like the resale market) today are challenging the traditional PR approach. [2] From TikTok resellers to major auction houses, the secondary luxury market continues to reshape the luxury industry, and brands are urged to extend control to not just what they sell, but how their products live beyond the sales point.

The Rise of the Resale Market

The Real Real. Photo Courtesy: The Real Real.

While the overall luxury spending faces a slight decrease, the luxury resale market, once a niche sector of vintage and antiques, expands rapidly and is expected to reach a 64-billion-dollar industry by this year, [3] with a strong compound annual growth rate of 10-15%. [4]

The motivation in buying second-hand luxury varies. For younger consumers, especially Millennials and Gen Z, luxury resale aligns with their value of sustainability and environmental consciousness, coinciding with the rising trend of vintage. It also serves as a gateway to luxury for aspirational consumers who can’t afford new luxury items, offering discounted access and small indulgences for younger generations who are facing rising unemployment, uncertain career prospects, and therefore delayed spending on luxury. [5] As for UHNWIs, resale is the access to rare and hard-to-require luxury items, with a strong focus on certain handbags, jewellery and watches. Furthermore, it also functions as an alternative investment, where rare Hermès pieces are often sold 25% more than the retail prices, and pre-owned watches from Rolex and Patek Philippe trade at average markups of 20% and 39%. [3] A report from Bain & Company shows jewellery and watches account for 80% to 85% of total resale, among which, jewellery is a particularly strong force, and apparel continues to grow as well. [6]

Online platforms like the RealReal, Vestiaire Collective and Depop have been the catalyst for the growth in the second-hand luxury market. Auction houses have now entered the scene as well. Sotheby’s, Christie’s, and London-based Roseberys all have departments dedicated to resales of jewellery, watches and handbags. Recently, the original Birkin, created for singer Jane Birkin, sold for a record-breaking $8.2 million ($10.1 million including fees) at Sotheby’s Paris, becoming the most expensive handbag ever sold at auctions. [7]

Original Birkin at Sotheby’s. Photo Courtesy: Reuters.

For niche auction houses like Roseberys, the luxury department is steadily growing, expanding beyond jewellery and watches into categories such as handbags. In their December 2024 sale, both jewellery and watches achieved strong results, with most lots sold and many exceeding the pre-sale estimates. [8][9]

Challenge the Narrative

Traditionally, luxury brands hold exclusive control over their narratives from global marketing campaigns to the interiors of physical boutiques. However, resale platforms challenge luxury brands through authentication, pricing and brand image. [10]

Problems with counterfeits have held many consumers sceptical towards buying pre-owned luxury. Most online resale platforms like Vestiaire Collective and Depop are operating on a C2C basis, which makes the verification process more difficult. Take Vestiaire Collective as an example, the company states that all the items go through a digital screening first. For pieces above €1,000, the platform requires a physical authentication at one of its verification centres. [3] However, the private-seller-on-public-platform mode remains sceptical for some buyers. Newer platforms like ReSee (co-founded by former Vogue and Self Service editors) and Sellier provide boutique-like resale experience and full-service authentication by an in-house team at premium prices with heavy fees, building more trust with consumers. [11]

Moreover, luxury brands have long relied on exclusivity and tightly controlled brand narratives as key tools of differentiation. Yet, the rise of the resale market, marked by fragmented messaging and variable pricing, has begun to decentralise brand authority over value perception. More accessible price points dilute the symbolic capital traditionally attached to luxury goods, redefining what it means to be a luxury owner. [12] With this new dynamic, value is increasingly determined by supply and demand, much like the stock market, further reducing the narrative power of the brands.

Sally He. Photo Courtesy: Roseberys.

Sally He, Luxury Item Specialist at Roseberys London, shared her insights on the luxury sector and the resale economy with us. Similarly, auction houses like Roseberys operate on a C2B2C system, which is a consumer-to-business-to-consumer model, allowing specialists to source handbags and jewellery from dealers and clients who are usually UHNWIs, select and authenticate products before listing on auction catalogues, which adds an extra layer of trust by ensuring the authenticity of their products.

The luxury department at Roseberys is relatively new and already experiencing steady growth. Sally believes the resale market is not only expanding but also reshaping the structure and perception of luxury. While their seller base includes UHNWIs, private clients, and estate-related consignments, the buyer demographic is notably younger. For many of these younger consumers, sustainability does play a role in motivating resale purchases, but accessibility and pricing remain the primary drivers, especially in contrast to boutique resale stores, where items are immediately available but often priced higher. In auctions, buyers are willing to wait in exchange for better value or even the chance to secure rare pieces below market price.

Sally also observed that rare or limited-edition designs remain key drivers of demand in the resale market. For example, a Vert Céladon Himalaya Kelly 32 will appear in Rosebery’s forthcoming September auction. Catalogue writing, meanwhile, increasingly focuses on storytelling, craftsmanship, and rarity, reinforcing perceived value and emotional connection. As more auction houses enter the resale space, brands are being forced to respond. Some are re-evaluating their core customer base and adopting price increases to maintain exclusivity, which ironically pushes even more consumers towards the resale channel, suggesting that resale is no longer a small sector, but a structural trend influencing both market behaviour and brand strategy. [13]

Vintage Himalaya Kelly 32. Photo Courtesy: Roseberys.

Brand Response

As the resale market expands, some brands respond by monitoring the programs more closely and implementing strategies to differentiate themselves from the secondary market, while others see this as an opportunity, starting to collaborate or launch their own platforms.

Some brands are changing their strategy to spotlight storytelling, craftsmanship and experience over luxury goods themselves. Loro Piana, for example, its centenary takeover of Harrods last year curated an immersive and multi-sensory narrative. The campaign involved storytelling displays on the outside walls of the department store, a designated space for personalisation service and pop-up workshops, inviting clients to craft their own holiday ornament using Loro Piana materials. An exclusive collection with Harrods and a book celebrating its 100-year history were also released. [14] The brand continued the strategy and presented its first exhibition, If You Know, You Know, in Shanghai this year. It explored Loro Piana’s heritage through rare fibres, archival material, and interactive installations, and highlighted the historical ties to China, reinforcing its narrative of cultural dialogue and global excellence. [15]

Loro Piana Exhibition in Shanghai. Photo Courtesy: LVMH.

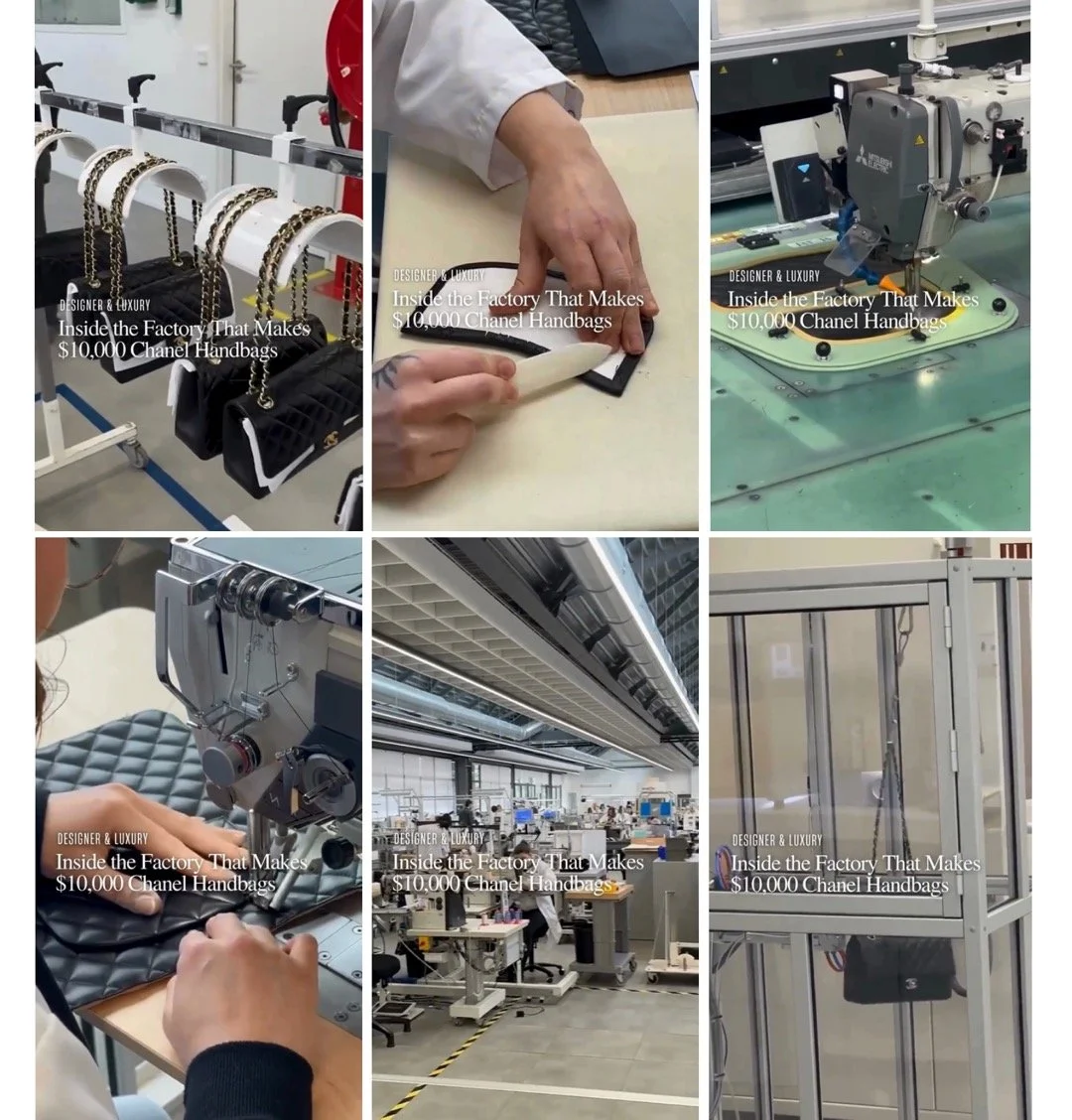

However, the strategy is not always successful. WWD, a major fashion media, posted a video on Instagram in April, featuring the behind-the-scenes production process of the classic Chanel 11.12 handbag. The video was meant to be a storytelling piece showcasing the craftsmanship, as well as communicating transparency and building consumer trust. Nevertheless, it backfired as the manufacturing process in the video appeared to heavily rely on machinery and be highly industrialised, and the presence of artisanship seemed minimal. Combining with Chanel’s price hikes in recent years, the comment section was filled with viewers questioning the true worth of a $10,000 USD bag. The video was deleted a few hours later, but the controversy remains. [16]

Screenshot from WWD video. Photo Courtesy: 2 Jour Stylist.

The luxury buyer base typically includes both core UHNWI clients and aspirational entry-level consumers. The second approach brands take is to shift their focus back to top-tier wealthy clients, rather than catering to the mass audience, by raising prices, monitoring resales more strictly, and providing private client experiences that reinforce aspirational values such as exclusivity, heritage, and status.

Chanel has implemented a global price increase at least once a year from 2016 to preserve exclusivity and market positioning, meanwhile also increasing the resale price. [17] Hermès has long employed scarcity as a brand strategy, limiting access to its iconic Birkin and Kelly bags through invitation-only policies and opaque waitlists.

Many brands are incorporating exclusive experience-based service that cannot be sold or replicated in the secondary market. For example, Dior’s collaboration with Belmond Hotels in 2022 transformed the gardens of Splendido in Portofino into a temporary Dior-branded spa and concept store, offering signature treatments and capsule collection items. [18]

Dior’s collaboration with Belmond Hotels ‘Garden of Dreams.’ Photo Courtesy: Kristen Pelou.

Similarly, the Swarovski Crystal Society offers its members unique experiential benefits like private museum access, personalised gifts, and invitations to exclusive events. Moncler’s ‘Art of Genius’ event combined fashion, music, and digital interactivity, with surprise performances by stars like Alicia Keys, creating a large-scale, immersive moment designed for the audience. [19]

The Art of Genius by Moncler. Photo Courtesy: Moncler Genius.

Some brands also see the resale trend as an opportunity to regain control over the narrative. For instance, Rolex launched a Certified Pre-Owned (CPO) program in 2022, allowing the brand to reclaim a measure of legitimacy and consistency in the resale of its watches. [20] Others, like Burberry and Stella McCartney, have partnered with Vestiaire Collective and The RealReal to promote the consignment of their products, often in alignment with their sustainability agendas. In addition, Gucci’s collaboration with The RealReal, and Richemont’s acquisition of Watchfinder and investment in Yoox Net-a-Porter (YNAP), illustrate how some brands are even building their own resale infrastructures. [3]

Future of Luxury

Looking ahead, the resale market will continue to grow in the luxury sector. In a world where ownership of goods is no longer the ultimate aspiration, the luxury industry is seemingly facing pressure from the secondary market, but the deeper challenge lies in shifting consumer values, economic uncertainty, and technology. A reasonable strategy for brands is to engage with experiential services, meaning, and emotions. This builds bonds between brands and consumers that could not be easily replicated. For future generations, an exclusive dinner party with the designer might mean more than the garment itself.

Looking to the art industry, Sotheby’s released the $700 million USD art-backed security last year, turning artworks into financial commodities. [21] Whether or not luxury goods will follow the same path remains to be seen, but the investment logic in the luxury sector is accelerating. The future of luxury may not rely on storytelling or craftsmanship, but the ability to connect, feel and prioritise meaning over acquisition.

Marina Yujie Liu

Luxury Edit Co-Editor, MADE IN BED

Footnotes

[1] The Business of Fashion. ‘“Trade War TikTok” Takes Aim at Luxury’. https://www.businessoffashion.com/articles/sustainability/trade-war-tiktok-luxury-brands-chinese-factories/.

[2] The Business of Fashion. ‘Luxury Has a Fake News Problem. Is Silence the Right Strategy?’, 30 April 2025. https://www.businessoffashion.com/articles/luxury/luxury-fake-news-chinese-manufacturer-tiktok/.

[3] London, Luxury, and Anna Solomon. ‘Pre-Loved and Premium: Inside the Second Hand Luxury Marketplace’. Luxury London (blog), 2 August 2024. https://luxurylondon.co.uk/style/hers/second-hand-pre-owned-luxury-fashion-handbags-jewellery-watches/.

[4] Villalón, Pablo Gutiérrez-Ravé. ‘Report on the Global Second-Hand Luxury Market’. LUXONOMY (blog), 25 June 2024. https://luxonomy.net/report-on-the-global-second-hand-luxury-market/.

[5] Bain & Co. ‘Following a Record Year, the Stalled Luxury Goods Market Faces a Dilemma between Catering to Top Clientele and Reaching New Audiences amid Ongoing Complexities’. https://www.bain.com/about/media-center/press-releases/2024/following-a-record-year-the-stalled-luxury-goods-market-faces-a-dilemma-between-catering-to-top-clientele-and-reaching-new-audiences-amid-ongoing-complexities/.

[6]D’Arpizio, Claudia, Federica Levato, Andrea Steiner, and Joëlle de Montgolfier. ‘Luxury in Transition: Securing Future Growth’. Bain, 17 January 2025. https://www.bain.com/insights/luxury-in-transition-securing-future-growth/.

[7] Roeloffs, Mary Whitfill. ‘The Lore Of The Hermès Birkin Bag, Explained—After $10 Million Sale’. Forbes. https://www.forbes.com/sites/maryroeloffs/2025/07/10/original-herms-birkin-bag-sold-at-auction-for-record-breaking-8-million/.

[8] ‘Roseberys London | Watches & Luxury Items (2024-12-05)’. https://www.roseberys.co.uk/watches-handbags/2024-12-05?display=grid&el=583802&header_id=0&is_heighlight=&keyword=&lo=ASC&pn=1&pp=96.

[9] ‘Roseberys London | Jewellery (2024-12-04)’. https://www.roseberys.co.uk/jewellery-watches/2024-12-04.

[10] ‘Faume | Luxury and Second-Hand: A Winning Duo’. https://www.faume.co/en/blog/luxury-and-second-hand-a-winning-duo.

[11] Biondi, Annachiara. ‘Meet the New Generation of Luxury Resellers’. Fashion. Financial Times, 18 July 2025. https://www.ft.com/content/5ffb915d-d6b1-4174-a12c-8962fd1c38d5.

[12] Land, Gabriella. High-End Hand-Me-Downs?: How Resale Is Reshaping Luxury Markets – Michigan Journal of Economics. 3 April 2025. https://sites.lsa.umich.edu/mje/2025/04/03/high-end-hand-me-downs-how-resale-is-reshaping-luxury-markets/.

[13] Sally He, Luxury Item Specialist at Roseberys, interview by Yujie Liu, July 16, 2025, London.

[14] The Rake. ‘Loro Piana Takes Over Harrods for Holiday Season’. October 2024. https://therake.com/default/stories/loro-piana-takes-over-harrods-for-holiday-season.

[15] ‘Loro Piana Celebrates Centenary with Stunning Exhi... - LVMH’. https://www.lvmh.com/en/news-lvmh/loro-piana-celebrates-centenary-with-stunning-exhibition-in-shanghai.

[16] Marina 2Jour. ‘Factory That Makes $10,000 Handbags: PR Breakdown of Chanel Communication Misstep’. 2Jour Stylist, 6 April 2025. https://www.2jour-stylist.com/post/factory-that-makes-10-000-handbags-pr-breakdown-of-chanel-communication-misstep.

[17] Wat, Vanessa. ‘Understanding the Latest 2024 Chanel Bag Price Hikes and the Resale Market’. Sothebys.Com, 22 January 2025. https://www.sothebys.com/en/articles/understanding-the-latest-2024-chanel-bag-price-hikes-and-the-resale-market.

[18] ‘Indulge in Extravagance: Discover the Luxury Experience’. https://www.glion.edu/magazine/luxury-experience/.

[19] Birjuk, Alina. ‘Luxury Redefined: From Ownership to Experience’. Medium, 8 April 2024. https://medium.com/@alinabirjuk/luxury-redefined-from-ownership-to-experience-4e1f0386b6e0.

[20] ‘Rolex Certified Pre-Owned Programme | About Rolex | Newsroom’. https://newsroom.rolex.com/about-rolex/rolex-certified-pre-owned-programme.

[21] Schneider, Tim. ‘Sotheby’s $700m Art-Backed Debt Security Explained’. The Art Newspaper - International Art News and Events, 23 May 2024. https://www.theartnewspaper.com/2024/05/23/gray-market-sothebys-700m-art-backed-debt-security-explained.